The Institute of Chartered Accountants of Barbados is currently undergoing a digital transformation. While we upgrade our online platform, we remain committed to keeping you informed.

Below, you’ll find the key information and resources you need during this transition.

Apply for admission to be an ordinary member of ICAB.

Apply for readmission to be an ordinary member of ICAB.

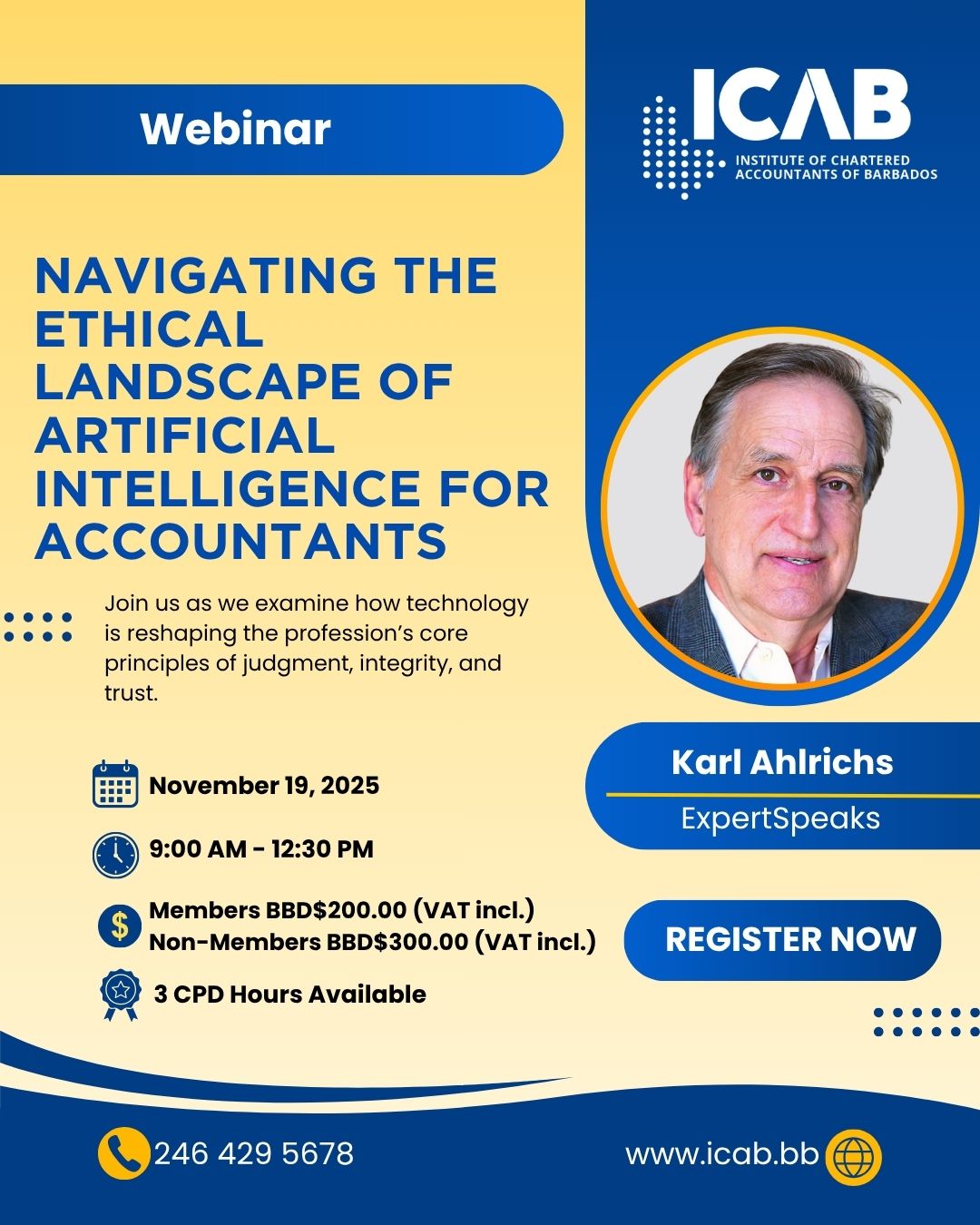

Register to attend any of our Continuing Professional Development (CPD) or member events.

Register to be a student member of ICAB.

Big changes are coming! Subscribe to be notified.

Institute of Chartered Accountants of Barbados

PO Box 168W

Room 29 Hastings Plaza Hastings

Christ Church, Barbados, BB15150

Copyright © 2025 Institute of Chartered Accountants of Barbados. All rights reserved.

You can reach us via email or phone or submit your information via our form.

Phone : +1 (246) 429-5678

WhatsApp : +1(246) 231-1357